The earlier we learn about money, the better.

When I think about my early introduction to money, it had little to do with how to use it properly. I didn't have money conversations growing up, and it wasn't until my back was against the wall and I was facing eviction that I started learning how money works. Financial literacy is a critical skill that lays the foundation for a stable and prosperous future. However, it's a subject that is often overlooked, especially when it comes to young girls, and more specifically, Black girls. As the gender and racial wealth gaps persist, it's imperative to equip our young girls with the tools and knowledge they need to navigate the financial world effectively. Introducing financial literacy in middle school can be a game-changer, providing these young minds with the confidence and skills they need to succeed.

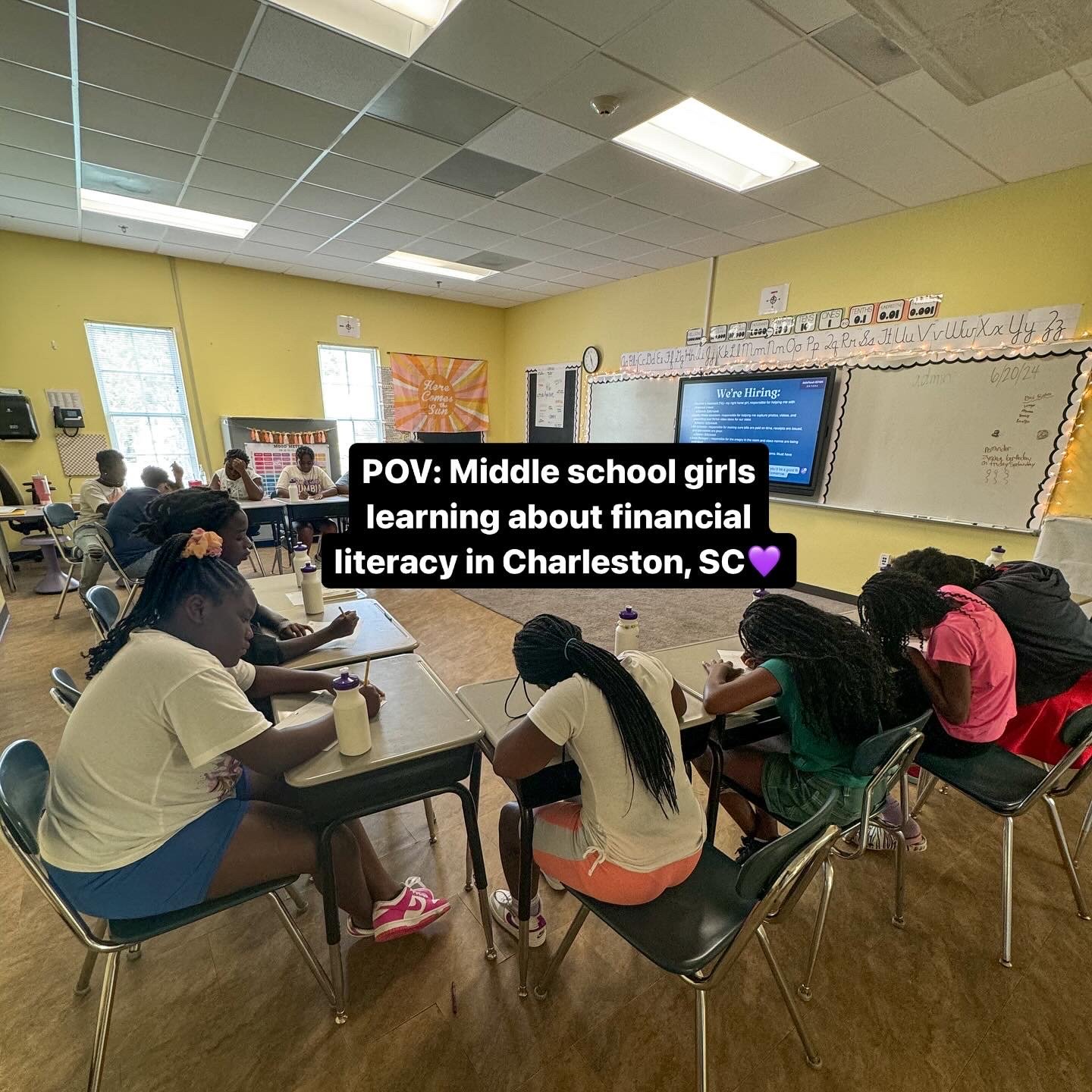

For the past three years, I've taught financial literacy to a group of middle school girls attending Horizons at Ashley Hall, a summer camp in Charleston, SC. When I was asked to teach the class, my initial thoughts were, "Will these students understand this?" "Will this be valuable for them even though they don't work jobs or have bills?". All valid thoughts, but I quickly realized the earlier we learn about money, the better, and here are 7 reasons why I believe this to be true.

1. Empowering Early Independence

Middle school is a pivotal time in a child's development. For Black girls, who often face unique societal challenges, learning financial literacy early on can foster a sense of independence. By understanding the basics of money management—such as budgeting, saving, and building credit—these young girls can begin to see themselves as financially capable individuals. This early empowerment can lead to greater confidence in their ability to make sound financial decisions as they grow older.

2. Bridging the Wealth Gap

The racial wealth gap is a well-documented issue, with Black households holding significantly less wealth than their white counterparts. By teaching Black girls about financial literacy at an early age, we can help to bridge this gap. Financial literacy education can provide them with the knowledge to make informed decisions about their finances, avoid debt traps, and invest wisely. Over time, these skills can contribute to closing the wealth gap for future generations.

3. Promoting Economic Equality

Economic equality is not just about closing the wealth gap but also about ensuring everyone has the same opportunities to succeed. Financial literacy education is a key component of this. By providing Black girls with the financial tools they need, we are promoting a more equal society where everyone can achieve financial stability and success. This not only benefits individuals but also strengthens the economy as a whole.

4. Counteracting Stereotypes and Bias

Black girls often face stereotypes and biases that can limit their opportunities and self-esteem. By teaching financial literacy in middle school, we can help counteract these negative influences. Financial education can show Black girls that they are just as capable of managing money and making smart financial decisions as anyone else. This can help to build their self-worth and encourage them to pursue their goals with confidence.

5. Building a Foundation for Future Success

Financial literacy is not just about understanding money; it's about the freedom to make choices, the confidence to take control of our own lives and of our communities, and the opportunity to shape our own futures. Thank you for that beautiful definition, John Hope Bryant (everyone should read his book 'Financial Literacy for All'). For Black girls, this means equipping them with the skills they need to navigate a world that may not always be supportive. By teaching financial literacy in middle school, we are giving these girls the tools they need to succeed in life, whether that means pursuing higher education, starting their own business, or simply managing their personal finances effectively.

6. Encouraging Entrepreneurial Mindsets

Middle school is the perfect time to introduce the concept of entrepreneurship to Black girls. Financial literacy education can include lessons on how to start a business, manage finances, and grow wealth through entrepreneurship. By encouraging an entrepreneurial mindset, we are helping to cultivate the next generation of Black women business leaders who can contribute to their communities and the economy at large.

7. Creating Role Models for Future Generations

When Black girls learn about financial literacy at a young age, they are more likely to grow up to be financially responsible adults. These women can then serve as role models for the next generation, passing on their knowledge and skills to their children and communities. This creates a positive cycle of financial education and empowerment that can benefit Black communities for generations to come.

Making it fun

My seven reasons have the power to enact long-term change, but it means nothing if the lessons aren't fun and engaging! This past summer, I implemented a program called "Rich Girl, Rich World." Rich Girl, Rich World was designed to help my students apply what they were learning during financial literacy class in real life. This is how it worked:

I began by giving each student $100. They had the opportunity to earn more money by showing good character, participating in class, and doing their jobs well (there were five positions available that they could apply for).

They had weekly bills to pay (Rent, Wifi, and Water) and access to purchase some of their favorite items from our class store every Friday.

At the end of the program, the biggest saver in 6th, 7th, and 8th grade received a $20 cash prize! I did not share the prize with the girls at the beginning of camp, and I believe this element of surprise encouraged some of my students to practice self-control and save money instead of spending it at the class store.

Financial literacy classes may seem more fitting for adults with financial responsibilities, but if we want to create a more equitable environment, we must have money conversations at an earlier age so that we can avoid future mistakes that trip so many of us up and perpetuate cycles of financial stress, worry, and poverty. When I look at each of my girls, I see mini Responsible Homegirls, girls who will talk to their friends and family about what they learned in financial literacy class and, one day, apply what they've learned to their life. If you're a teacher or you work with young adults, consider implementing a financial literacy course for them to learn about money. This education can help to bridge the wealth gap, promote economic equality, and create a foundation for lifelong success. It's time to prioritize financial literacy education for all and ensure everyone has the tools to thrive in a financially complex world.