3 Easy Steps to Budget Your Money Consistently and Know Exactly Where Your Money is Going.

Year after year, we tell ourselves “I’m going to save more money”, “I’m going to manage my money better”, or “I’m going to pay off this credit card debt”. There's nothing wrong with saying these things but just saying it isn’t enough. We need a plan and not the kind that you create at the top of the year and forget about it. We need a plan everytime money touches our hands or our bank account.

If you want to start budgeting in 2024 and stop worrying about money that’s already spent, read this post to learn:

What budgeting actually is

A step by step process of how to budget

Two tools I’m using this year to budget consistently

I’ve been where you are before: stressed about money and working really hard and having nothing to show for it. When I started treating my budget as my financial GPS my finances turned around dramatically so I hope you’re excited to learn how to budget forreal this time.

What is Budgeting?

When we typically think about budgeting, words come to mind like “limits” or “restrictions”, but budgeting is simply the process of creating a plan for where your money is going and how it should be used. Your budget gives your money direction and a clear plan for how it will be used until the next time you get paid. I want to challenge you to look at budgeting from a place of planning and power. Proverbs 21:5 says “Good planning and hard work lead to prosperity but hasty shortcuts lead to poverty”. When we budget, we set time aside to plan, to be proactive, and allow our money to be a servant instead of the other way around. Too many of us are serving money. We work to have enough to pay our bills, eat at a few restaurants, buy a few clothing items, and we’re in constant pursuit of more instead of managing the money we have well.

How to budget in 3 easy steps (step-by-step)

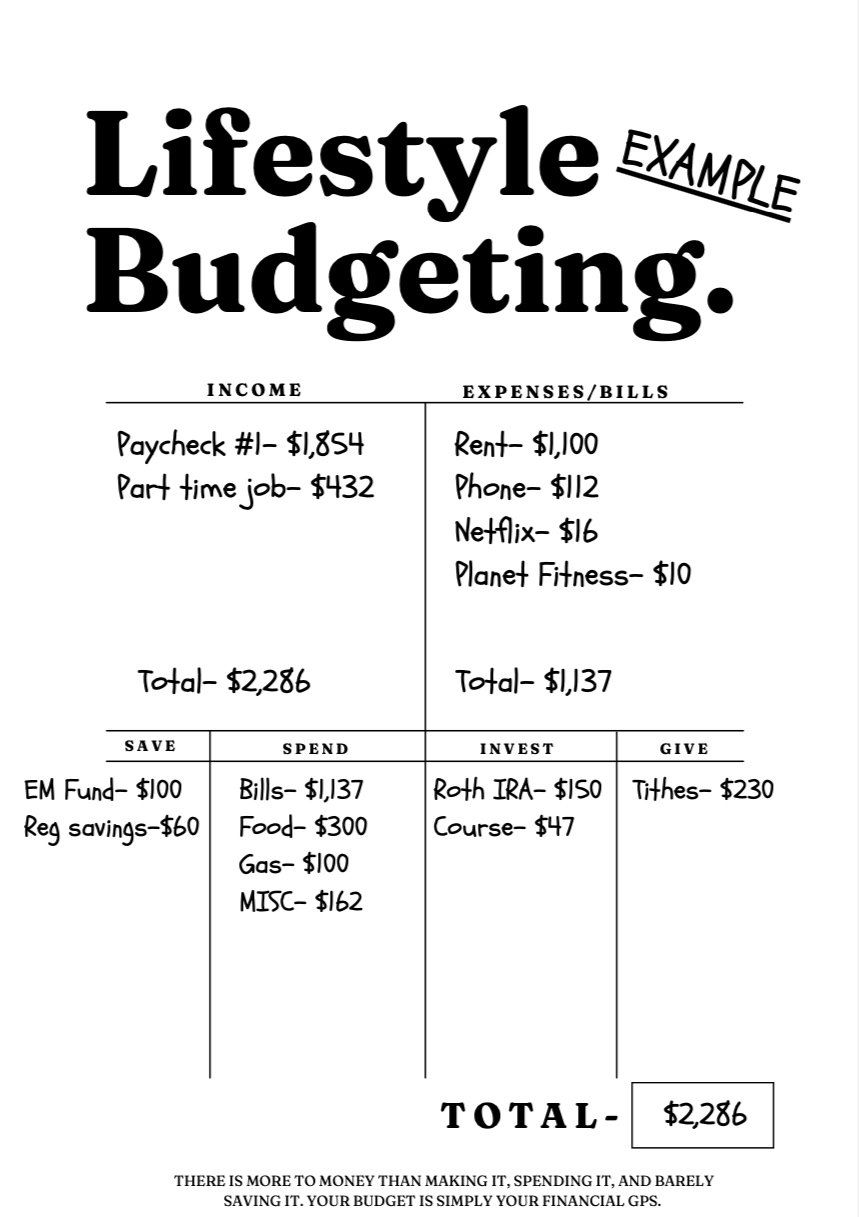

Budgeting isn’t as hard as we make it seem. Below is a template taken from my budgeting planner I created to help you budget every time you get paid. Before we get into the 3 steps, I want you to be open to budgeting in a new way and commit to planning on payday! I strongly dislike monthly budgets. Because your budget is your plan, I believe every time you get paid you need to create a plan. It’s no different than waking up in the morning and brushing your teeth. Brushing your teeth is a natural response to waking up in the morning to prepare for your day, and budgeting/ creating a plan is a natural response to getting paid. Now let’s get into how to budget in 3 easy steps:

List your income: Remember, NO cookie cutter monthly budgets. Think about your budget as a plan. Every time you get paid, you should create a BUDGET! Be sure to list your income for this pay period ONLY. Next time you get paid, you’ll create a new budget.

List your expenses/bills: Remember, we are budgeting one paycheck at a time so only list your bills that are due during this pay period. Include the due date by each bill.

Separate your money: This is the time to tell your money where to go; give your money direction. There are 4 ways to use money as a tool: save, spend, invest, and give. For short, remember S.S.I.G.

Look at the budgeting template below for an example of how your budget should be set up and pre-order The Responsible Homegirl Planner to have access to the templates every time you get paid. Budgeting isn’t something we do once a month.. on payday, we plan! Budgeting is apart of our lifestyle.

Two tools I’m using to budget consistently:

The first tool I’m using to budget consistently is The Responsible Homegirl Planner! This 6-month dateless planner is my constant reminder to plan on payday and keep track of the money I earn. It doesn’t matter how much money you make, if it’s not monitored, it will slowly but surely slip away from you.

The second tool I’m using is an app called So-Fi! I love So-Fi because it gives you a full picture of your finances once you connect your bank accounts, and the High-Yield Savings Account (HYSA) has an interest rate of 4.6% when you set up direct-deposit. A HYSA is an account we all need! It pays you a higher interest rate on the money in your savings account. Would you rather a 4.6% interest rate or 0.25%? Yea, okay. Click here to open up your account and share it with your homegirls too! They are always giving out money for sharing the app with your friends.

Plan for a peace of mind.

Once I learned and implemented those 3 easy budgeting steps, I finally gained a peace of mind around my finances. I stopped making excuses for my unnecessary spending and stopped asking myself the ridiculous question “where did my money go?” after spending my money with no plan in place. Follow these steps and start budgeting consistently in 2024 and beyond!

If you’re not ready to go all in on budgeting consistently using The Responsible Homegirl Planner and So-Fi, I want you to download my free money management guide! This guide will help you get clear and organized enough to start your personal finance journey. I also have a free savings guide to help you save money if you struggle with saving and want to save at least $1,000 before 2024 ends!